My Cup Of Liberty

By Bienvenido S. Oplas, Jr.

On Oct. 22, The International Monetary Fund (IMF) released the World Economic Outlook (WEO) and its corresponding database, an Excel file of macroeconomic data covering 197 countries and territories, with the data spanning from 1980 to projections until 2029. The IMF releases the WEO twice a year, in April then an update in October.

I always download the Excel files of the database.

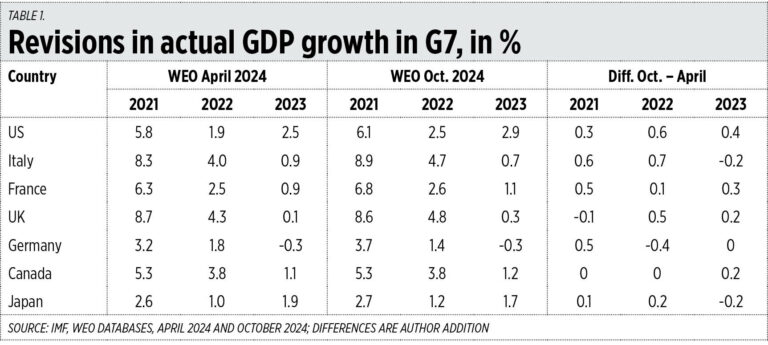

I compared the GDP growth in October vs the April data and one thing I noticed is that there were no significant changes in past growth among Asian countries but there were significant changes in growth among the G7 industrial countries from 2021 to 2023.

The most notorious when it comes to upward revisions in data are the US and Italy. The percentage growth in 2022 and 2023 were changed by the US from 1.9% and 2.5% in the April WEO, to 2.5% and 2.9% in the October WEO. The least changes made were by Canada and Japan (see Table 1).

One possible explanation why the US government made these big upward revisions in growth just a month before the Presidential elections is perhaps to propagate their narrative that the US economy has been doing good under the Biden-Harris administration. Usually, changes are made in projections for the current and next year’s growth, not past years’ growth.

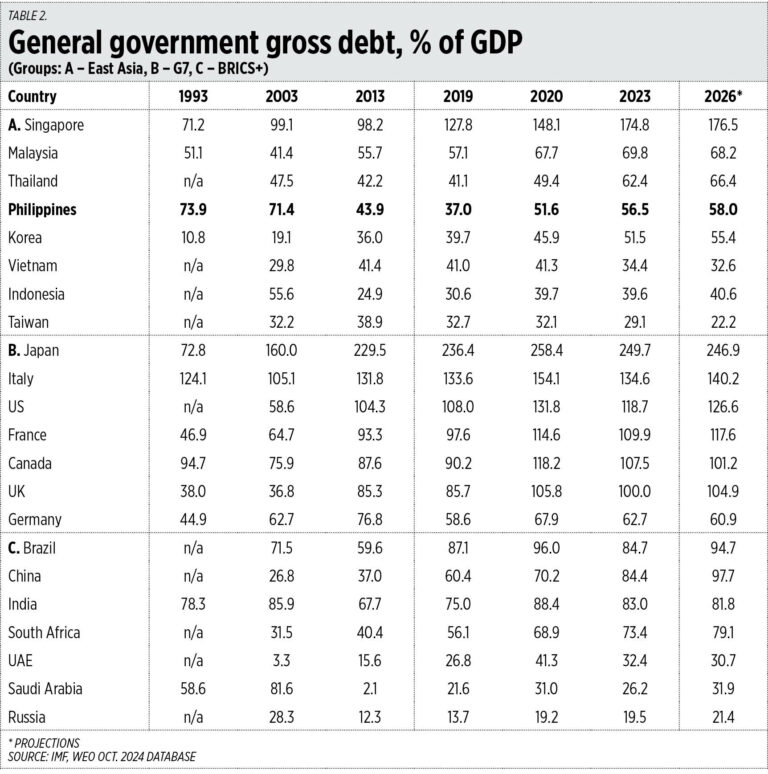

Another piece of data that I checked in the WEO October update was the Debt/GDP ratio. There were minimal changes from the April report, but the trend remains the same — the Debt/GDP ratio of many countries keeps rising, not falling, not even remaining flat.

This is highly visible among G7 countries, led by Japan, Italy and the US. It is also seen in East Asia except Taiwan. The G7’s rival bloc, the expanded BRICS (Brazil, Russia, India, China, South Africa) that now include Saudi Arabia, the United Arab Emirates, Iran, Egypt and Ethiopia, have lower ratios than G7 members (see Table 2).

HEADING THE G-24

I read in the Department of Finance’s (DoF) Viber community thread that the current Chair of the Intergovernmental Group of 24 (G-24) Board of Governors is our own Finance Secretary Ralph G. Recto, and that he has led this year’s “successful high-level meeting of ministers and governors in Washington, DC where he championed four key reforms to empower the IMF and World Bank Group to better serve developing countries.”

Congratulations, Sec. Ralph. I hope the officials and leaders of the G-24 realize that among the best strategies to develop their economies is to observe more fiscal discipline and responsibility and wean themselves away from further indebtedness whether from the IMF-WB-ADB or commercial lenders.

Meanwhile, on the Facebook page of Department of Budget and Management (DBM), I read about the planned Fiscal Policy Conference with a theme, “Efficient governance towards a stronger fiscal future” that will be held at the University of Asia and the Pacific on Oct. 23. DBM Secretary Amenah F. Pangandaman was supposed to give the Opening Remarks of the first-ever public conference on this subject. Unfortunately, this week’s storm has led to the cancellation of the conference.

Public spending on infrastructure should focus more on preparing for global cooling, not warming. The trend now includes, among others, longer phases of La Niña vs El Niño, rising rivers, lakes, and creeks due to frequent flooding and not rising sea levels, the simultaneous cooling of the Pacific and Atlantic Oceans, etc.

Meanwhile, the Philippine Economic Society (PES) will hold its annual conference on Nov. 7 and 8 at Novotel, Cubao, Quezon City. The theme is “Traversing innovative pathways for economic resilience, inclusion and localization in the Philippines.” I am a lifetime member of the PES and I try to attend the annual event whenever possible.

Among the activities — aside from having plenty of plenary and simultaneous panel discussions — is the election of the new Board of Directors of the PES. Among the candidates is my friend, Dr. Elyxzur “Prof. X” Ramos (whom I personally nominated), the current President of University of Makati. Prof. X is an academic, a university administrator, a member of EDCOM 2, and a researcher of the current economic environment of the country. I hope he makes it to the PES Board.

Philippine Economic Society (PES)

Philippine Economic Society (PES)